Diageo to expand its business in África

At the same time, Diageo has strengthened its position in the American market.

Today we are going to consider a listed company in 5 different markets: Diageo, which is the owner of well-known luxury brands such as Johnnie Walker or Guiness. According to its Chief Executive Officer (CEO) Ivan Menezes, the company wants African business to be 20% of its total revenues, where it has invested more than 1 million Euros in countries with a high demand growth such as Ethiopia.

Diageo, considered as the biggest alcoholic beverages company in the world, is positioned in 16 African countries and its products are sold in other 40, which will represent 20% of global population in 2030 according to the World Bank. This “growth” bet has lifted up total investment worldwide to USD 225 million.

At the same time, Diageo has strengthened its position in the American market. The company has bought a Mexican firm called “Tequila Don Julio” for USD 408 million. Diageo seeks doubling sales in Mexico in a market with a volume of transactions worth ranged from USD 3 billion to USD 4 billion.

However, this growing company has been unable to convince market consensus and investors. Given the 2014 results (balance sheet and income statement), we observe how main luxury brands sales have dropped sharply. For example, sales of vodka brand Smirnoff have decreased 7% as Johnnie Walker sales slipped 14% on a constant exchange rate basis. As consumer expectations and luxury goods demand are highly correlated, this situation is a signal of economic weakness.

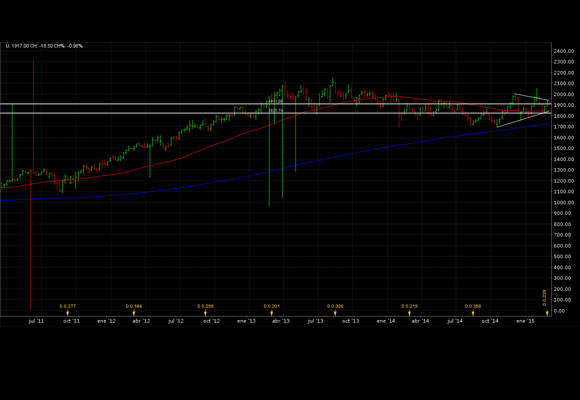

Diageo shares are poised by the situation described before. If we observe its prices in the London Stock Exchange, shares are moving in a short range around GBP 1,920. According to Mr. Javier Arroyo, economist and partner of Anoa Capital, Diageo shares are bearish in the short-run with two price objectives: «The first one is GBP 1,900 and the second one, GBP 1,870. As we can see in the Weekly graph stated before, investors who want to put money in Diageo should be careful because we are seeing many “long washings” that damage small and medium stockholders».

Disclosure: The author is not responsible for the views expressed in the article. The text has been written freely expressing ideas, without receiving any compensation. The author has no business relationship with any of the companies whose shares are listed in this article.